If you’re planning on hitting the road with your boat on a vacation, you’ll want to make sure you do all you can to secure it. Below are the best tactics to put in place so that your boat is protected when traveling to and from your destination.

1. Strap it Down

Even if you have one of the best and strongest boat trailers available, you still need to ensure you’re strapping your boat down to it. Traveling over long highways can hit bumps, and poor road conditions can cause your boat to bounce. If the boat isn’t secure with heavy straps, it could bounce off the trailer and be damaged.

2. Cover Your Boat

Before you apply the final straps to your boat, you’ll want to put a cover on the boat first. This keeps debris and environmental elements from damaging the windshield and interior of the boat. A heavy-duty cover will protect the boat’s shell, even if you travel under low-lying trees along the highway. Once you park your boat trailer, you can leave the cover on it when you aren’t using it for additional protection until you head home.

3. Make Sure Your Trailer is Locked

While you have your boat in a trailer while traveling, you want to keep it secure so it can’t be stolen at night. Lock the trailer and hitch so that a vehicle can’t be hooked to the trailer and carry the boat off. It’s also a good practice to set an alarm on the boat so that if there is movement or someone attempts to start the boat, you’re notified right away.

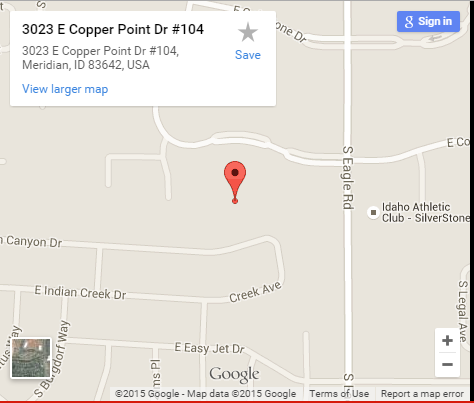

If you’re in the Meridian, ID area and need boat insurance, contact our team at Idaho Select Insurance today for more information.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions