Did you know that life insurance goes beyond term and whole life insurance? Well, there are many types of life insurance policies designed to provide financial security to your loved ones. It’s easy to feel overwhelmed over which policy to buy, especially if it’s your first time. At Idaho Select Insurance, we recommend going through the two main types before breaking them down to other policies. Once you know which type fits your needs, you can check other products in that category to determine what works for you.

Your needs

Many people in Meridian, ID buy life insurance to provide for their families once they are gone, but that is not the only reason. In fact, you can buy life insurance for any financial reason under the sun. Knowing your life insurance needs will guide you into the type of policy that matches your financial goals.

Your age

Age is often a factor when buying insurance, as it affects almost every aspect of your policy. If you are a senior parent, you may want to buy permanent life insurance instead of term life insurance. Younger people on a budget tend to choose term life insurance to match their future financial goals.

Your state of health

Most life insurance providers in Meridian, ID will require you to take a medical exam or answer specific medical questions to determine the state of your health. Typically, the healthier you are, the longer you’re likely to live and the less expensive the policy. For this reason, you may want to go for a policy that is more flexible and allows you to live your life as you wish. For instance, if you buy permanent life insurance, you don’t have to worry about losing money when the expiration date approaches.

Talk to us

Get a customized life insurance policy and protect your loved ones at Idaho Select Insurance. Our dedicated team of professionals is always ready to handle any challenge you might have when choosing coverages. Call us today.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

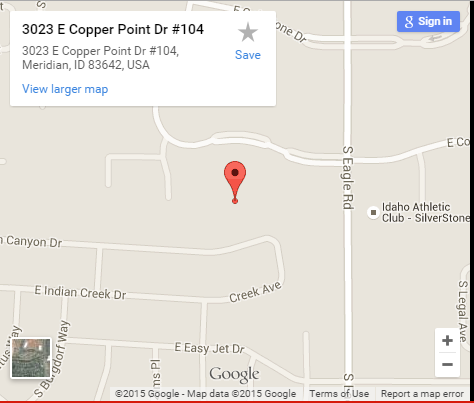

Get Directions