If you are a tenant in Meridian, ID, you should consider renters insurance from Idaho Select Insurance. Renters insurance covers your personal assets and protects you when faced with liability claims. While renters insurance can be a lifesaver, you should know that it doesn’t cover you against all risks. Here are the common renter’s insurance exclusions.

Flood damage

Like home insurance, renters insurance doesn’t cover you against flood damage. You can boost your renter’s insurance by purchasing flood insurance from the National Flood Insurance Program (NFIP) or private providers. This insurance covers your assets, lessening your financial burden when disaster strikes.

Earthquakes

Renter’s insurance doesn’t cover sinkholes, mudslides, or earth movement damage. However, like flood insurance, you can purchase earthquake insurance to boost your renters insurance.

Your roommate’s possessions

Renters insurance covers your assets when damaged inside or outside your dwelling. However, renters insurance won’t extend to your roommate’s possessions. As such, your roommate should have their own coverage, or you can opt for a shared policy.

High-value items

Like home insurance, renters insurance provides limited coverage to your high-priced items like jewelry, cash, and art. However, you can purchase supplemental insurance to provide optimal protection for your valuable assets.

Mold and pest infestation

Most renter insurance policies won’t cover damage from pests, rodents, or mold. These are considered maintenance-related issues that can be prevented with proper care for the property.

Your vehicle

Renters insurance will cover the loss or damage to the assets inside your car, but not the vehicle itself. You should file a claim with your car insurance when your car suffers damage.

Renters insurance in Idaho

Want to learn more about renters insurance? If you are in Meridian, ID, please get in touch with Idaho Select Insurance for personalized advice.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

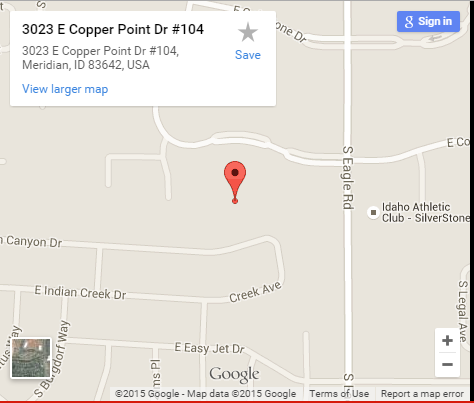

Click to Call Get Directions

Get Directions