Ladies and Gentlemen – start your engines! Hold on one second! Do you have proper insurance coverage? If not, you are not only risking your vehicle, but you are breaking the law. Did you know it’s illegal to operate a motor vehicle on the road of Meridian, ID without proper insurance coverage? It’s true, and something that Idaho Select Insurance is here to help with. Read on to learn how to find the best auto insurance policy at the best price.

1. Compare Several Auto Insurance Quotes

If you are eager to get behind the wheel and begin cruising, then you may not care who or where your auto insurance comes from – you have your eye on the prize – driving. However, this may result in you paying way too much for the coverage you need.

As a result, the best thing you can do is to compare quotes before making a decision and purchasing a policy. Be sure to be thorough and compare the prices and coverage line by line to find the insurer that provides the most value. (Pro tip: The company offering the most value won’t always be the one with the lowest price!).

2. Bundle Your Auto Insurance with Other Policies

Do you have homeowners or renters insurance? Have you purchased life insurance in the past? If so, then you are already working with an insurance company. Why not reach out to your existing insurance provider about bundling your new auto policy with your other coverage. This may help you save some cold, hard cash.

3. Find a Reputable Agent for Help

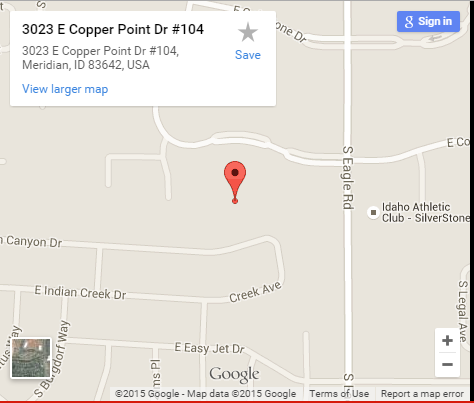

Perhaps the best thing you can do when it’s time to purchase auto insurance is to work with a quality agent. At Idaho Select Insurance we serve the entire Meridian, ID area and our agents can help you get the policy you want and need to get you on the road as quickly as possible.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions